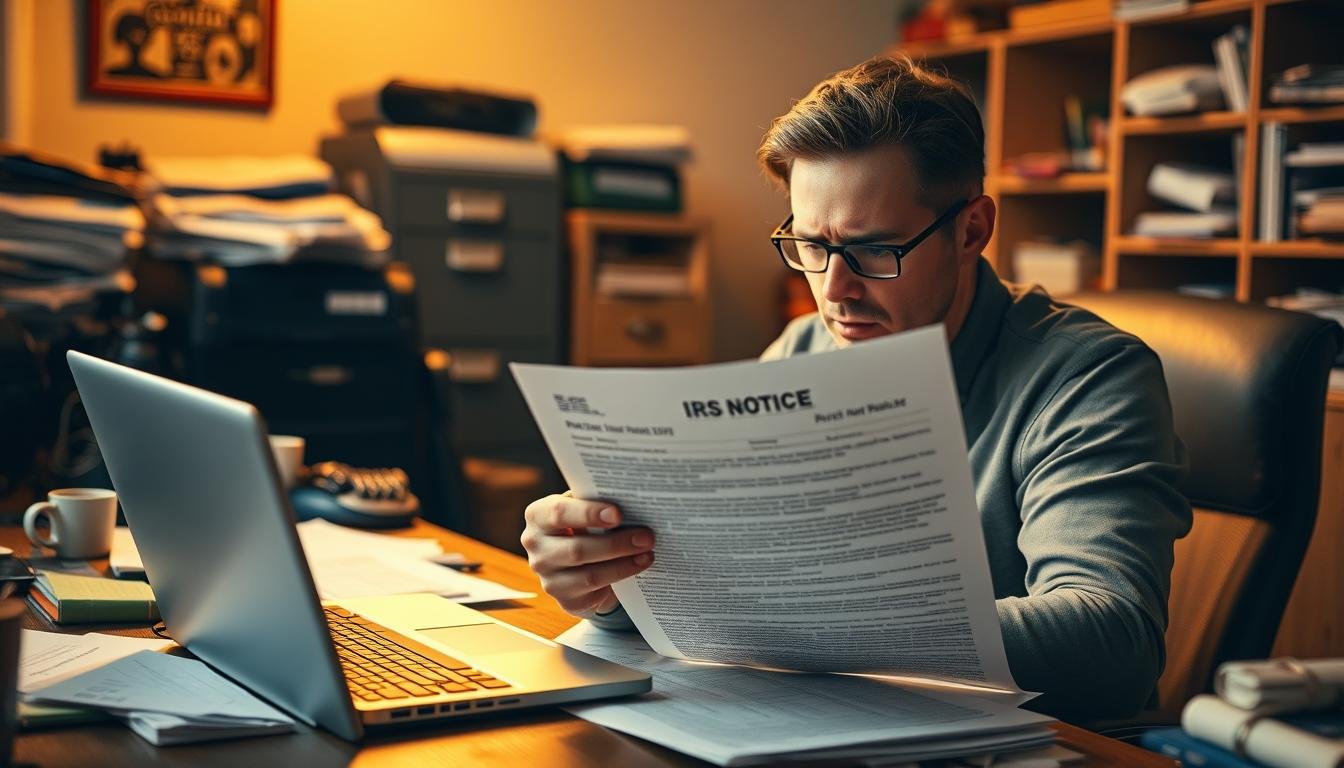

Millions of Americans annually fail to meet the tax filing deadline, incurring penalties and fines. The stress of missing this critical date is palpable. Fortunately, obtaining a tax extension can alleviate this burden.

This article will elucidate the process and advantages of securing an extension, alongside the repercussions of tardiness. By comprehending your options, you can make strategic decisions regarding your tax responsibilities.

Key Takeaways

- Understand the process of filing for a tax extension

- Learn the benefits of filing for a tax extension

- Discover the consequences of missing the tax deadline

- Know how to avoid penalties and fines

- Get guidance on making informed tax decisions

What You Need to Know About Tax Filing Deadlines

Grasping the nuances of tax filing deadlines is paramount for both individuals and corporations to sidestep penalties and adhere to IRS mandates. The tax deadline, generally set for April 15th, necessitates annual verification due to potential alterations by various factors.

Impact of Holidays and Weekends

In scenarios where April 15th coincides with a weekend or a federal holiday, the tax filing deadline is extended to the subsequent business day. For example, if April 15th lands on a Saturday, the deadline shifts to the ensuing Monday. This provision affords taxpayers additional time to submit their returns, thereby mitigating the risk of late filing penalties.

Certain scenarios can modify the tax deadline for particular taxpayers. For instance, individuals in combat zones or those impacted by natural disasters might qualify for a filing extension. Furthermore, taxpayers residing outside the United States are granted an automatic two-month extension, setting their initial deadline at June 15th.

It is imperative to acknowledge that the IRS may declare special extensions or modifications to the tax filing deadline in response to unforeseen circumstances. Keeping abreast of official IRS announcements is crucial for taxpayers to remain informed about any such alterations.

How to File an IRS Extension in 2025

Our guide will navigate you through the intricacies of filing an IRS extension in 2023, encompassing the essential steps and available avenues. Acquiring an extension grants taxpayers the requisite time to meticulously complete their tax returns.

The process of filing an IRS extension is remarkably straightforward, offering taxpayers multiple pathways based on their preferences and circumstances. The paramount consideration is to select the method that aligns with your needs, ensuring timely submission.

IRS Free File Program

The IRS Free File Program emerges as a premier choice for taxpayers whose incomes fall within specific thresholds. This initiative empowers eligible taxpayers to file their tax returns and extensions without incurring costs. Eligibility hinges on an adjusted gross income (AGI) not exceeding $73,000. The IRS Free File Program stands as a cost-effective and convenient avenue for extension filing.

To leverage the IRS Free File Program, taxpayers must visit the IRS website and access the Free File page. There, a comprehensive list of participating software providers and their respective eligibility criteria awaits. Select a provider that aligns with your requirements and follow their directives to file your extension.

Tax Software Solutions

For those not eligible for the IRS Free File Program or seeking a more structured experience, tax software solutions present a viable alternative. Renowned providers such as TurboTax, H&R Block, and TaxAct offer extension filing services. These platforms facilitate the process, ensuring the accurate completion of necessary forms.

Utilizing tax software necessitates the provision of personal and financial data. The software will then prepare and submit your extension request to the IRS. This approach is particularly advantageous for those who are adept with technology and seek a streamlined filing process.

For those inclined towards paper filing, completion of Form 4868 is required, followed by mailing it to the IRS. The mailing address varies by location. The IRS website furnishes a comprehensive list of addresses for Form 4868 submissions. It is imperative to utilize the correct address to avert potential delays.

When submitting your extension form via mail, ensure the inclusion of all requisite information and a signature. Maintaining a copy for personal records is advisable. Although paper filing remains a valid option, it is generally slower than electronic filing methods.

In conclusion, the filing of an IRS extension in 2023 can be executed through diverse methods, each offering unique advantages. Whether opting for the IRS Free File Program, tax software solutions, or traditional paper filing, the critical factor is to submit your extension before the deadline to circumvent penalties.

The Truth About IRS Extensions: What They Actually Provide

An IRS extension transcends mere deadline extension; it embodies a critical financial decision. By opting for a tax extension, taxpayers merely acquire additional time to submit their tax returns, not to defer tax payments.

Seeking an extension request can avert the failure-to-file penalty, a penalty that the IRS imposes with severity. The magnitude of this penalty underscores the gravity of failing to file on time.

Failure-to-File Penalty

The failure-to-file penalty is calculated at 5% of unpaid taxes for each month or fraction thereof that the return is late, capping at 25%. This penalty is levied when a taxpayer misses the original deadline or the extended deadline, if an extension was sought.

Consider a scenario where a taxpayer owes $1,000 in taxes and delays filing by 3 months without an extension. The penalty would amount to 15% of $1,000, or $150, plus interest on the unpaid amount.

| Penalty Type | Penalty Rate | Maximum Penalty |

|---|---|---|

| Failure-to-File | 5% per month | 25% |

| Failure-to-Pay | 0.5% per month | 25% |

Failure-to-Pay Penalty

In contrast, the failure-to-pay penalty is less stringent, at 0.5% of unpaid taxes for each month or fraction thereof, also capping at 25%. However, this penalty can be mitigated or averted by filing for an extension and paying as much of the tax liability as possible by the original deadline.

“The IRS is more lenient with taxpayers who file on time but can’t pay their tax bill immediately, compared to those who don’t file at all.”

Securing a tax extension and making timely payments can significantly diminish the risk of incurring these penalties. It is crucial for taxpayers to recognize that while an extension extends the filing deadline, it does not absolve them from interest on taxes owed after the original deadline.

Grasping the implications of an IRS extension and the associated penalties is essential for taxpayers to make informed decisions regarding their tax obligations. By judiciously filing for an extension when necessary and ensuring timely payments, taxpayers can circumvent substantial financial penalties.

Benefits of Filing an IRS Extension

Filing for an IRS extension emerges as a pivotal strategy for taxpayers confronting the necessity of additional time to meticulously organize their financial records. This is crucial for ensuring the precision and accuracy of their tax filings.

The ability to make informed decisions regarding retirement account contributions stands out as a significant advantage of opting for an IRS extension.

Retirement Account Contributions

An IRS extension grants taxpayers the time needed to thoroughly evaluate their financial standing. This enables them to make strategic contributions to retirement accounts, such as IRAs or 401(k)s. Such contributions can significantly reduce taxable income.

Furthermore, the opportunity to meticulously gather and document business expenses is another notable benefit.

Business Expense Documentation

For self-employed individuals or those with intricate business expenses, an IRS extension facilitates a comprehensive review and organization of expense records. This ensures that all eligible deductions are claimed, thereby optimizing tax benefits.

By electing to file for an IRS extension, taxpayers can circumvent the anxiety associated with the urgency of meeting the tax filing deadline. This approach also enables them to potentially reduce their tax liability through meticulous planning and accurate reporting.

In summary, the advantages of filing an IRS extension include the provision of additional time to review financial records, strategize retirement contributions, and document business expenses. These factors collectively contribute to a more accurate and potentially less burdensome tax filing experience.

Special Extension Rules for Different Taxpayer Categories

Taxpayers encountering unique circumstances, such as those in combat zones or earning income internationally, face formidable challenges in tax filing. The IRS addresses these hurdles by implementing special extension rules tailored to various taxpayer categories.

Combat Zone Extensions

Individuals deployed in combat zones or qualified hazardous duty areas are entitled to an automatic tax filing extension. This extension encompasses both the filing and payment deadlines, offering respite during perilous and demanding conditions.

The duration of the extension generally spans 180 days post-exit from the combat zone or hazardous duty area. Furthermore, taxpayers receive an extension for the days remaining to file or pay upon entering the combat zone, alleviating their tax burdens.

Foreign earned income taxpayers may also benefit from special provisions. The Foreign Earned Income Exclusion (FEIE) enables eligible taxpayers to exclude specific foreign earnings from their taxable income, potentially lowering their tax liability.

To qualify for the FEIE, taxpayers must fulfill either the Bona Fide Residence Test or the Physical Presence Test. The Bona Fide Residence Test necessitates being a bona fide resident of a foreign country or countries for an uninterrupted period encompassing an entire tax year. Conversely, the Physical Presence Test mandates physical presence in a foreign country or countries for at least 330 full days within any 12 consecutive months.

Taxpayers claiming the FEIE must submit Form 2555 with their tax return. It is imperative to recognize that the FEIE is not an automatic exclusion; taxpayers must file the requisite forms and fulfill the eligibility criteria.

Grasping these special extension rules can facilitate taxpayers’ navigation through intricate tax scenarios. Whether in a combat zone or earning income abroad, cognizance of these provisions can profoundly influence one’s tax obligations and potential savings.

State Tax Extensions: What You Should Know

Understanding the intricacies of state tax extensions is paramount for individuals and businesses navigating the complexities of tax deadlines. The necessity for a state tax extension arises when the original tax filing deadline is not feasible, necessitating an extension to complete the tax filing process accurately and within the legal timeframe. This provision is particularly crucial for those facing unforeseen circumstances or requiring additional time to gather all necessary documentation.

It is essential to recognize that a state tax extension does not automatically extend the deadline for federal tax filings. Therefore, it is imperative to file for both state and federal tax extensions separately to avoid penalties and interest on unpaid taxes. The process of obtaining a state tax extension typically involves submitting Form 4868 to the IRS, which grants an automatic six-month extension for federal tax filings. However, for state tax extensions, the procedure may differ, and it is advisable to consult with a tax professional to ensure compliance with state-specific requirements.

While a state tax extension provides relief from immediate penalties, it is important to note that it does not waive the requirement to file a tax return. The extended deadline for state tax filings must still be met to avoid additional penalties and interest. Furthermore, it is crucial to understand that an extension to file is not an extension to pay, and timely payment of taxes is still required to avoid interest and penalties. Therefore, it is advisable to plan for the payment of taxes during the extension period to avoid any additional financial burdens.

In conclusion, a state tax extension is a valuable tool for managing tax deadlines, but it requires careful planning and adherence to specific procedures. By understanding the nuances of state tax extensions and the necessary steps to obtain one, individuals and businesses can effectively navigate the complexities of tax filings and avoid unnecessary penalties.

What Happens After You File an IRS Extension

Upon securing an IRS extension, the imperative subsequent action is to verify the possession of requisite documentation. The extension grants additional time for tax document submission, yet it is paramount to preserve accurate records throughout this interval.

Documentation to Maintain

Throughout the extended timeframe, it is imperative to retain all pertinent tax documents. This encompasses income statements, deduction records, and any supplementary documents pertinent to your tax filing. Specifically, this includes:

- Form 1099 for various types of income

- Charitable donation receipts

- Medical expense records

- Any other relevant tax-related documents

Retention of these documents is crucial to ensure readiness for tax filing.

Proof of Filing Extension

Acquiring proof of filing for your extension form is equally crucial. This can manifest as a confirmation number or a duplicate of the electronically submitted extension form. For example, if you electronically filed Form 4868, retention of the confirmation number is advised, as it acts as your filing proof.

A succinct table is provided to facilitate tracking of essential documents and information:

| Document Type | Importance | Retention Period |

|---|---|---|

| Form 4868 confirmation | High | 3 years |

| Income statements | High | 3 years |

| Charitable donation receipts | Medium | 3 years |

By diligently maintaining documentation and securing proof of filing, a seamless tax filing process during the extended period is ensured.

Consequences of Missing the Extension Deadline

Missing the IRS extension deadline can lead to severe repercussions, including failure-to-file penalties and additional interest. It is imperative to comprehend these consequences to mitigate further financial strain.

The failure-to-file penalty is calculated at 5% of the unpaid taxes for each month or fraction thereof that the return is late, capping at 25%. For instance, if the unpaid tax amount is $1,000 and the filing is delayed, a $50 penalty is incurred for the initial month. Additionally, interest on the unpaid amount accrues, escalating the debt owed to the IRS.

IRS Fresh Start Program

The IRS Fresh Start program is a mechanism to assist taxpayers grappling with tax liabilities. It offers more flexible terms, such as expanded installment agreements and offers in compromise. For example, the IRS may accept an offer in compromise if it believes the proposed amount is the maximum collectible from the taxpayer over time.

“The IRS Fresh Start program is a legitimate initiative that can help taxpayers avoid penalties and minimize their tax liability.”

Payment Plans and Offers in Compromise

For taxpayers unable to settle their tax liabilities in full, payment plans or offers in compromise are viable options. Payment plans enable taxpayers to make monthly installments toward their debt, whereas offers in compromise allow for settling the debt for less than the full amount owed. The table below delineates the primary distinctions between these alternatives.

| Option | Description | Key Benefits |

|---|---|---|

| Payment Plans | Monthly payments toward tax debt | Avoid penalties, manageable monthly payments |

| Offers in Compromise | Settle tax debt for less than the full amount | Reduce total tax liability, eliminate debt |

It is essential to note that the IRS reviews each case individually to determine eligibility for these programs. Seeking counsel from a tax professional is crucial to ascertain the most suitable strategy for one’s unique circumstances.

We are dedicated to guiding you through the intricacies of IRS regulations. Grasping the repercussions of missing the extension deadline and exploring alternatives like the IRS Fresh Start program can empower you to make informed decisions regarding your tax obligations.

Conclusion

In our discourse on IRS extensions, it is paramount to underscore the significance of judicious utilization of the additional time afforded. The act of filing for an IRS extension grants taxpayers a reprieve, enabling them to meticulously complete their tax filings. This, in turn, minimizes the risk of errors and the concomitant penalties.

Upon submitting an extension request, taxpayers are granted an extension, facilitating the collection of essential documents, consultation with tax professionals, and the verification of the accuracy of their tax filings. This is particularly advantageous for those with intricate tax scenarios or those whose financial circumstances have undergone significant alterations.

We implore taxpayers to leverage this extended timeframe to meticulously review their tax filings. Submission prior to the extended deadline is imperative, thereby averting late filing penalties and the accrual of interest on unpaid taxes, consequences of missing the IRS extension deadline.