A recent survey revealed that nearly 50% of Americans would struggle to cover a $400 unexpected expense without going into debt.

This stark reality highlights the critical need for a robust financial safety net. An emergency fund acts as a vital buffer against life’s uncertainties, encompassing medical emergencies, car repairs, and job loss.

By establishing a well-planned emergency fund, individuals can ensure they’re better equipped to handle financial shocks without derailing their long-term financial goals.

Key Takeaways

- Understand the importance of having an emergency fund.

- Learn how to determine the right size for your emergency fund.

- Discover strategies for building your emergency fund.

- Find out how to maintain and adjust your emergency fund over time.

- Explore tips for avoiding common pitfalls in emergency fund management.

What is an Emergency Fund?

An emergency fund constitutes a fundamental element of a robust financial strategy, serving as a protective barrier against unforeseen financial burdens. It is a designated reservoir of capital, earmarked for addressing unexpected expenditures such as medical emergencies, vehicular repairs, or unforeseen job loss. The establishment of an emergency fund is indispensable for safeguarding financial well-being and maintaining fiscal equilibrium.

The fundamental objective of an emergency savings fund is to equip individuals with the capability to navigate through financial crises. It transcends mere accumulation of capital; it necessitates the accumulation of a quantifiable sum within a readily accessible savings account. This reserve serves as a cushion, enabling individuals to confront unforeseen expenses without resorting to debt or compromising their long-term investments.

The terms rainy day fund and emergency fund are frequently interchanged, yet they both signify a reserve for unforeseen expenses. The critical distinction lies in their purpose: they are not intended for planned expenditures such as vacations or the acquisition of new electronic devices but are reserved for genuine emergencies.

Effective money management mandates the establishment and maintenance of an emergency fund. It embodies a proactive stance, predicated on foresight and preparedness. Several critical considerations are pertinent:

- Assessing the optimal savings amount, contingent upon one’s expenses and financial commitments.

- Selecting a savings account that is liquid and offers a competitive interest rate.

- Periodically reassessing and recalibrating the emergency fund to reflect evolving financial circumstances.

| Expense Type | Average Cost | Emergency Fund Coverage |

|---|---|---|

| Medical Emergency | $1,000 – $5,000 | 3-6 months expenses |

| Car Repairs | $500 – $2,000 | Partial coverage |

| Job Loss | 3-6 months salary | Full coverage |

By comprehending the significance of an emergency fund and its role within a broader financial strategy, individuals can enhance their capacity to manage financial risks and secure a more stable fiscal future.

Why You Need an Emergency Fund

In today’s unpredictable world, the necessity of a financial safety net is more pronounced than ever. Global events, such as conflicts and economic shifts, can impact anyone’s financial stability. An emergency fund serves as a buffer, ensuring readiness for unexpected expenses.

Having an emergency fund is critical for maintaining financial security. It aids in avoiding debt by providing necessary funds during emergencies, reducing financial stress. By saving for unforeseen circumstances, one can maintain financial stability even in the face of unexpected events.

- Avoiding debt during financial crises

- Reducing financial stress by having a safety net

- Maintaining financial stability during uncertain times

For instance, during the recent global economic shifts caused by US tariffs, a cushion of savings helped many individuals and businesses navigate through financial turmoil. It is a prudent step to start building your emergency fund, even if you’re starting with little money.

By prioritizing your savings and creating an emergency fund, you are taking a proactive step towards securing your financial future. It’s about being prepared for the unexpected and maintaining peace of mind.

How Much Should You Save?

Establishing the appropriate emergency fund amount is imperative for sound financial planning. The requisite savings amount is influenced by several critical variables, namely, your income, monthly expenditures, and the presence of dependents.

Factors to Consider

In the process of determining your emergency fund, several elements must be taken into account:

- Monthly Expenses: Your emergency fund should suffice to cover 3-6 months of living costs, encompassing rent/mortgage, utilities, groceries, transportation, and the minimum debt payments.

- Job Security: Individuals in precarious employment or with fluctuating incomes may necessitate a more substantial savings reserve.

- Dependents: The presence of dependents, such as children or elderly relatives, escalates the necessity for a more substantial emergency fund to ensure their well-being in unforeseen circumstances.

- Health and Insurance: Your health status and insurance coverage are also determinants. Those with chronic health conditions or insufficient insurance may require a larger emergency fund.

While a common guideline suggests saving 3-6 months’ worth of expenses, this figure can fluctuate based on personal circumstances. For example, those who are self-employed or have non-traditional income sources might need to allocate more funds to their emergency reserves.

For instance, if your monthly expenses amount to $3,000, your target for the emergency fund should range from $9,000 to $18,000. It is advisable to place this fund in a readily accessible account, such as a high-yield savings account.

By meticulously evaluating these factors and tailoring your savings strategy, you can construct a formidable emergency fund. This fund will serve as a bulwark against financial uncertainty, affording you both security and tranquility.

Creating a Budget to Save

The establishment of a budget is fundamental to the accumulation of an emergency fund. It necessitates a thorough comprehension of one’s income and expenditures, facilitating the strategic allocation of resources towards savings. Mastery over money management is imperative for the attainment of financial equilibrium.

Initiating the process involves the meticulous tracking of expenses to discern the destinations of one’s financial resources. Utilization of budgeting applications, spreadsheets, or even a traditional notebook can serve this purpose. Through the monitoring of expenditures, one can pinpoint opportunities for the reduction of non-essential outlays. Minimizing unnecessary spending is essential for augmenting the availability of funds for savings.

Subsequent to gaining clarity on one’s financial obligations, the allocation of income towards various categories, including savings, can commence. The 50/30/20 principle, which allocates 50% of income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment, can act as a paradigm for financial planning.

Implementing an automated savings mechanism can simplify the process further. Establishing automatic transfers from one’s checking to savings or emergency fund accounts guarantees consistent savings without the need for manual intervention.

Regularly reviewing and revising one’s budget is equally critical. As income or expenses fluctuate, the budget must adapt to these changes. This ensures the continued effective allocation of funds towards savings objectives.

Adherence to these methodologies and a steadfast commitment to budgeting will enable the effective management of personal finance and the establishment of a substantial emergency fund.

Choosing the Right Savings Account

In the realm of emergency savings, the selection of a savings account profoundly influences financial stability. The plethora of available options necessitates a thorough comprehension of each account’s characteristics, facilitating an informed decision-making process.

Interest rates are a critical factor to consider. High-yield savings accounts stand out, boasting higher interest rates than traditional accounts. This feature enables the growth of your emergency fund over time.

“High-yield savings accounts are an excellent choice for emergency funds because they offer liquidity and a higher interest rate than standard savings accounts.”

When selecting a savings account for your emergency fund, several factors merit consideration:

- Interest Rate: Seek accounts with competitive interest rates to optimize your savings.

- Liquidity: Confirm that your funds are accessible when required, without incurring penalties.

- Fees: Opt for accounts with minimal or no fees to prevent erosion of your savings.

- Minimum Balance Requirements: Be aware of accounts necessitating a minimum balance to avoid fees or to earn interest.

| Account Type | Interest Rate | Liquidity | Fees |

|---|---|---|---|

| High-Yield Savings | 2.0% | High | $0 Monthly Maintenance |

| Traditional Savings | 0.1% | High | $5 Monthly Maintenance (waived with $100 minimum) |

| Money Market Account | 1.5% | High | $10 Monthly Maintenance (waived with $1,000 minimum) |

The table above highlights the diverse benefits of different savings accounts. High-yield savings accounts, for instance, are favored for their higher interest rates, making them a preferred option for emergency funds.

The optimal savings account for your emergency fund hinges on your unique financial circumstances and objectives. A meticulous evaluation of your options, taking into account interest rates, liquidity, and fees, will enable you to make a decision that fortifies your financial security.

Setting Savings Goals

To establish a robust emergency fund, it is imperative to articulate your savings goals with precision. This necessitates the identification of a specific target sum and the formulation of a pragmatic timeline to its attainment.

Formulating specific savings goals is a cornerstone in the development of a focused financial strategy. It enables the strategic allocation of resources, facilitating incremental progress towards the desired objective.

- Assess your financial situation to determine how much you can save each month.

- Decide on the total amount you need for your emergency fund.

- Set a realistic timeline to achieve your savings goal.

- Consider factors like income, expenses, and other financial obligations.

A meticulously crafted savings plan can be segmented into achievable milestones. The subsequent table exemplifies a sample savings plan:

| Monthly Savings | Target Amount | Timeline (Months) | Total Savings |

|---|---|---|---|

| $500 | $6,000 | 12 | $6,000 |

| $250 | $3,000 | 12 | $3,000 |

| $750 | $9,000 | 12 | $9,000 |

By adhering to these guidelines and tailoring a savings plan to your unique circumstances, you can efficiently build your emergency fund. This, in turn, will significantly bolster your financial planning endeavors.

Automating Your Savings

Implementing an automated savings mechanism is a highly effective strategy for maintaining a consistent savings regimen. This approach involves establishing a system where a predetermined amount is systematically transferred from your checking account to a savings or emergency fund account at predetermined intervals. Such a method ensures that savings are prioritized without necessitating manual intervention.

The benefits of automating savings are multifaceted. It guarantees the regular transfer of a fixed amount, eliminating the need for manual intervention. This method is instrumental in accumulating a substantial emergency fund over time. It also aids in resisting the urge to spend funds earmarked for savings, a common pitfall in traditional savings methods.

To initiate automated savings, leveraging online banking services or mobile banking applications is advisable. These platforms typically offer the capability to configure automatic transfers between accounts. Users can select the frequency of these transfers, aligning them with their income cycles, such as weekly or monthly.

For example, if your salary is received on the 1st of each month, configuring an automatic transfer to your emergency fund on the 2nd is feasible. This approach ensures that savings are consistently prioritized.

Key advantages of automating your savings include:

- Consistency in saving

- Reduced temptation to spend

- Ease of use through online banking services

Automating your savings is a potent strategy for advancing your emergency fund accumulation. It leverages technology to streamline the savings process, making it a simple yet impactful method for achieving financial objectives.

What to Keep in Your Emergency Fund

In the creation of an emergency fund, the selection of assets is of utmost importance. The objective is to amass liquid assets, those capable of swift conversion into cash, should unforeseen circumstances arise.

Liquid assets, by definition, retain their value with minimal depreciation upon conversion to cash. Illustrative examples include high-yield savings accounts, money market funds, and short-term CDs. These financial instruments are preferred for their inherent low-risk nature and immediate accessibility.

Regarding the fund’s allocation, a common guideline suggests a reserve sufficient to cover three to six months of living expenses. Financial advisors concur that such a reserve can adequately mitigate the impact of unforeseen events as advocated by industry professionals.

When determining the composition of your emergency fund, it is imperative to exclude assets characterized by volatility or illiquidity, such as stocks or real estate. Prioritize a balance between the ease of access and the return on investment. This equilibrium ensures that your emergency fund remains a steadfast source of financial security.

- Keep your emergency fund separate from your everyday spending money.

- Choose accounts that are low-risk and liquid.

- Regularly review and adjust your emergency fund as needed.

Adherence to these principles enables the establishment of an emergency fund that offers reassurance and financial security during times of need.

Common Mistakes to Avoid

Many individuals encounter challenges in establishing a robust emergency fund, often due to avoidable errors in their financial planning. An effective emergency fund necessitates an understanding of these common pitfalls and proactive measures to circumvent them.

One of the most significant errors is not saving enough. Many underestimate the necessary savings, rendering them susceptible to financial shocks. It is imperative to meticulously assess one’s expenses and income to determine a suitable savings goal.

- Failing to account for inflation and rising costs of living

- Not considering irregular expenses, such as car maintenance or medical bills

- Underestimating the impact of job loss or reduced income

Another critical mistake is using the emergency fund for non-essential expenses. The temptation to utilize savings for discretionary spending can deplete the fund at critical times. To circumvent this, it is advisable to maintain the emergency fund separate from everyday spending funds.

Here are some common mistakes to avoid when creating an emergency fund, along with some statistics to highlight their impact:

| Mistake | Impact | Prevalence |

|---|---|---|

| Not saving enough | Increased financial vulnerability | 60% of Americans can’t cover a $1,000 emergency |

| Using fund for non-essential expenses | Depletion of emergency fund | 40% of emergency funds are used for non-emergency purposes |

| Not reviewing or updating the fund | Outdated savings goals | Only 25% of Americans review their emergency fund annually |

To circumvent these errors, it is essential to regularly review and update your emergency fund. This ensures that your savings remain congruent with your current financial circumstances and objectives.

By comprehending these common pitfalls and proactively avoiding them, one can establish a robust emergency fund, providing financial security and peace of mind.

When to Use Your Emergency Fund

Grasping the appropriate moment to access your emergency fund is imperative for preserving financial stability. This fund acts as a financial bulwark, intended to absorb unexpected financial burdens or shortfalls. It is, though, critical to deploy it prudently to prevent unnecessary depletion of resources.

Identifying Legitimate Emergencies

Not every financial adversity merits the label of an emergency. Legitimate scenarios for utilizing your emergency fund encompass:

- Job loss or significant reduction in income

- Medical emergencies or unexpected health expenses

- Urgent home repairs or maintenance

- Car repairs or other essential vehicle expenses

Before accessing your emergency fund, conduct a thorough evaluation of the situation. Inquire if the expense is genuinely unavoidable and if viable alternatives exist.

Replenishing Your Emergency Fund

Post-utilization of your emergency fund, replenishment is imperative. Initiate by recalibrating your budget to direct a greater share of your income towards savings. Consider temporarily curtailing non-essential expenditures to expedite the replenishment endeavor.

By comprehending the optimal timing for emergency fund utilization and the methodology for its replenishment, you can sustain a formidable financial safety net. This not only fortifies your financial security but also affords tranquility amidst uncertainty.

How to Grow Your Emergency Fund

To fortify your financial safety net, it is imperative to incrementally augment your emergency fund over an extended period. This endeavor transcends mere accumulation of a singular sum; it necessitates a perpetual influx of capital. Financial advisors concur that maintaining three to six months’ worth of expenses in reserve is a prudent benchmark.

The cultivation of an emergency fund demands a synergy of discipline and strategic planning. Automating your savings emerges as a potent methodology. By configuring automatic transfers from your checking to your savings or emergency fund, you ensure a consistent, unobtrusive contribution to your reserve.

Strategies for Growing Your Emergency Fund

- Automate your savings to make regular contributions.

- Take advantage of high-yield savings accounts to earn interest.

- Review and adjust your budget to allocate more funds towards savings.

- Avoid dipping into your emergency fund for non-essential expenses.

Accruing interest on your savings can significantly bolster your emergency fund’s growth. High-yield savings accounts, for example, proffer superior interest rates relative to conventional savings accounts.

| Account Type | Interest Rate | Benefits |

|---|---|---|

| High-Yield Savings | 2.0% – 2.5% | Higher interest earnings, liquidity |

| Traditional Savings | 0.1% – 0.5% | Easy access, low risk |

| Certificates of Deposit (CDs) | 2.0% – 4.0% | Higher interest rates, fixed term |

By adopting these strategies and adopting a long-term outlook, you can effectively augment your emergency fund. This enhancement not only bolsters your financial resilience but also secures your financial well-being.

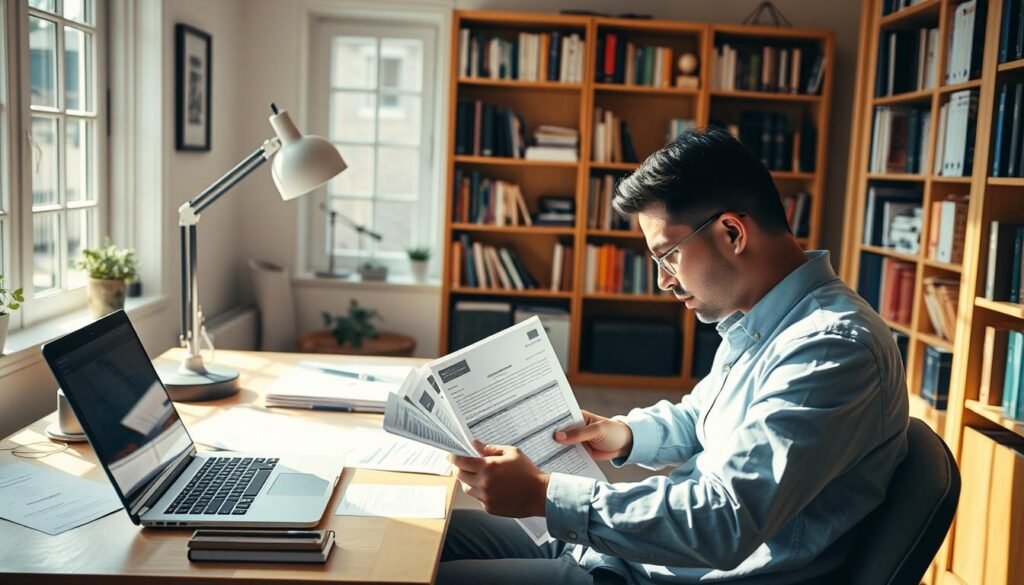

Reviewing Your Emergency Fund Annually

An annual review of your emergency fund is imperative to ensure its continued relevance amidst evolving financial landscapes. As your income, expenses, and financial objectives shift, so must your emergency fund’s configuration. Regular assessments facilitate adherence to your financial trajectory and necessitate timely adjustments.

“A well-maintained emergency fund is a cornerstone of financial stability,” opines financial expert, Jean Chatzky. “Annual reviews are critical to affirm its ongoing support for your financial well-being.”

During your annual review, consider the following:

- Changes in your income or expenses

- New financial goals or obligations

- The performance of your savings account or investments

Through annual reviews, you can make informed decisions regarding your financial planning. This ensures your emergency fund remains effective in meeting your needs. Such a process is vital for maintaining a robust financial safety net.

Tax Implications of Your Emergency Fund

Grasping the tax implications of your emergency fund is imperative for adept financial planning. The interest garnered on your emergency fund can significantly affect your fiscal strategy, necessitating a thorough comprehension of these tax implications.

Typically, emergency funds are stored in savings accounts or other liquid, interest-bearing instruments. The interest accrued on these instruments is deemed taxable by the IRS. This necessitates the inclusion of this income on your tax return, influencing your overall fiscal strategy.

Tax Implications to Consider:

- Interest Income: The interest garnered on your emergency fund is taxable.

- Tax Rate: The tax rate applied to the interest income hinges on your overall income tax bracket.

- Reporting Requirements: You will receive a Form 1099-INT from your bank detailing the interest earned, which must be reported on your tax return.

To mitigate the tax implications, consider the following strategies:

Strategies to Minimize Tax Implications:

| Strategy | Description | Benefit |

|---|---|---|

| Tax-Advantaged Accounts | Utilize tax-advantaged accounts such as Roth IRAs or Health Savings Accounts (HSAs) for your emergency fund. | Potential tax-free growth or withdrawals. |

| High-Yield Savings Accounts | Choose high-yield savings accounts that are FDIC-insured. | Earn higher interest rates while keeping your funds liquid and secure. |

| Tax-Efficient Investing | For a portion of your emergency fund, consider tax-efficient investment options. | Minimize tax liabilities on your investments. |

By comprehending the tax implications of your emergency fund and implementing strategies to minimize these implications, you can optimize your financial planning and maximize the efficacy of your savings.

Resources for Building an Emergency Fund

Several resources can aid in building an emergency fund, from budgeting apps to savings calculators. These tools are designed to help individuals manage their finances more effectively and make saving easier.

To start, it’s essential to understand the types of resources available. Budgeting apps like Mint, You Need a Budget (YNAB), and Personal Capital can help track expenses and identify areas where savings can be increased. These apps often provide automated savings features and alerts to help stay on track.

Savings calculators are another valuable resource. They can help determine how much to save based on income, expenses, and financial goals. NerdWallet and Bankrate offer reliable savings calculators that can provide personalized savings targets.

Popular Budgeting Apps:

- Mint: Offers automated budgeting and tracking features.

- You Need a Budget (YNAB): Focuses on managing expenses and saving.

- Personal Capital: Provides a comprehensive view of finances, including investments.

In addition to budgeting apps and savings calculators, financial planning tools can offer guidance on managing debt, improving credit scores, and investing for the future. Tools like Credit Karma and Investopedia can provide educational resources and planning aids.

| Resource Type | Examples | Benefits |

|---|---|---|

| Budgeting Apps | Mint, YNAB, Personal Capital | Track expenses, automate savings, financial overview |

| Savings Calculators | NerdWallet, Bankrate | Determine savings targets, personalized financial planning |

| Financial Planning Tools | Credit Karma, Investopedia | Debt management, credit score improvement, investment guidance |

By leveraging these resources, individuals can create a robust emergency fund that aligns with their financial goals. It’s about finding the right combination of tools that work best for one’s financial situation.

Ultimately, building an emergency fund is a crucial step in financial planning. With the right resources and a bit of discipline, anyone can establish a safety net to protect against financial shocks.

Success Stories

Countless individuals have successfully established and sustained emergency funds, securing their financial well-being and tranquility. A quintessential example is a family in the United States, who diligently saved three months’ worth of expenses. This prudent measure enabled them to adeptly manage unforeseen car repairs and medical bills, circumventing the perils of debt.

These narratives underscore the critical role of an emergency fund in mitigating life’s unpredictabilities. By prioritizing emergency savings, individuals can circumvent financial anxieties and propel themselves toward their long-term objectives. The presence of an emergency fund empowers individuals to embark on calculated risks, such as career transitions or educational investments, with the assurance of a financial safety net.

By adhering to the strategies delineated in this article, you can emulate the financial security achieved by those who have effectively managed their emergency funds. Initiate the construction of your financial safety net today, and revel in the diminished financial stress and enhanced peace of mind that ensue.