Over the past century, equities have delivered average annual returns of approximately 10%, while fixed-income securities have yielded around 5%. This stark contrast highlights just one of many fundamental differences between these two cornerstone investment options.

When navigating financial markets, understanding the distinction between ownership and lending is critical. Ownership represents a share of a company’s future, while lending functions as a loan with promised repayment terms. These differences significantly impact how your money grows and the risks you face.

The choice between these primary asset classes isn’t simply about returns. It involves considerations of time horizons, risk tolerance, and financial goals. Many successful investors don’t view this as an either/or decision but as complementary components within a diversified portfolio.

Throughout this guide, we’ll explore how these instruments work, their historical performance patterns, and strategies for incorporating both into your investment approach. Whether you’re just starting your financial journey or refining an existing strategy, understanding these foundational elements will empower your decision-making.

Key Takeaways

- Equities historically offer higher returns (10% annually) but with greater volatility than fixed-income securities (5%).

- Ownership instruments represent partial company ownership, while lending instruments function as loans with promised repayment.

- Risk profiles differ significantly between these two major asset classes.

- Most balanced portfolios include both types of securities in varying proportions.

- Your time horizon and financial goals should guide your allocation decisions.

- Market conditions affect each asset class differently, creating opportunities for strategic positioning.

Understanding Stocks and Bonds

Financial assets encompass a myriad of forms, with stocks and bonds serving as the bedrock for both novice and seasoned investors. These instruments embody fundamentally disparate strategies for wealth accumulation, each boasting distinct attributes, advantages, and perils.

What Are Stocks?

Stocks embody equity ownership within a corporation. Acquisition of stock shares equates to acquiring a fractional interest in the entity, conferring upon the investor a degree of proprietorship. This proprietorship affords shareholders certain prerogatives not accessible to bondholders.

Shareholders are endowed with voting rights, enabling them to influence critical corporate decisions. These decisions may encompass the election of board members, approval of mergers, or the ratification of significant corporate policies. The extent of voting influence is directly proportional to the number of shares held.

Many established corporations distribute a portion of their profits to shareholders in the form of dividends. These periodic distributions serve as a source of income for investors while preserving their equity stake. Not all corporations, though, elect to distribute dividends, opting instead to reinvest profits for expansion.

Stock values are subject to fluctuation, influenced by a multitude of factors:

- Company performance and earnings reports

- Industry trends and competitive positioning

- Market sentiment and investor psychology

- Broader economic conditions and interest rates

This volatility presents both opportunities and risks for stock investors. While prices can escalate significantly, generating wealth through capital appreciation, they can also plummet dramatically during market downturns.

What Are Bonds?

Bonds serve as debt instruments, where investors extend loans to entities—be it a government, municipality, or corporation—for a stipulated duration. Unlike stocks, bonds do not signify ownership but establish a creditor relationship.

Upon acquiring a bond, the issuer undertakes to repay the principal (original investment) at a predetermined maturity date. Throughout the bond’s tenure, investors receive regular interest payments, commonly referred to as “coupon payments,” which offer a predictable income stream.

Bond prices are influenced by distinct factors than stocks:

- Interest rate movements (bond prices typically move inversely to interest rates)

- Credit quality of the issuer

- Time remaining until maturity

- Inflation expectations

While generally less volatile than stocks, bonds are not devoid of risk. Variations in interest rates, inflation, or an issuer’s creditworthiness can impact bond values and returns.

Key Differences Between Stocks and Bonds

| Characteristic | Stocks | Bonds |

|---|---|---|

| Relationship to Issuer | Ownership (equity) | Lender (debt) |

| Income Generation | Dividends (optional, variable) | Interest payments (guaranteed, fixed) |

| Growth Potential | Unlimited upside | Limited to interest plus principal |

| Volatility | Higher | Lower |

| Legal Standing | Last claim on assets | Priority claim over stockholders |

The fundamental distinction between these investment options resides in their risk-reward paradigms. Stocks typically offer higher growth potentials but are accompanied by greater volatility and risk. Bonds, conversely, provide more predictable income with lower volatility, appealing to conservative investors or those nearing retirement.

Grasping these two primary financial assets constitutes the cornerstone of investment acumen. Most diversified portfolios integrate both stocks and bonds in varying proportions, contingent upon the investor’s objectives, time horizon, and risk appetite.

The symbiotic nature of stocks and bonds renders them formidable tools when employed in tandem. Stocks facilitate growth during market expansions, whereas bonds offer stability and income during contractions. This intrinsic relationship elucidates why these two investment options remain central to most investment strategies.

Historical Performance of Stocks and Bonds

The historical trajectory of stocks and bonds elucidates a complex narrative of risk, reward, and economic correlation spanning over a century. This performance data is indispensable for investors contemplating allocation decisions within the contemporary market landscape.

An examination of the stock market over extended durations reveals its superior growth capability vis-à-vis other asset classes. Despite encountering significant downturns, such as the Great Depression, the 2008 financial crisis, and the 2020 pandemic crash, major indices have demonstrated remarkable resilience.

The S&P 500, for instance, has delivered average annual returns of approximately 10% sine its inception in 1926. This performance significantly outpaces inflation, which has averaged roughly 3% annually over the same period. A $10,000 investment in the S&P 500 in 1970 would have grown to over $1.5 million by 2023, illustrating the efficacy of compounding in equity markets.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” – Benjamin Graham

The bond market, by contrast, has historically delivered more modest but stable returns. U.S. Treasury bonds have averaged annual returns between 3-5% over the past century, with investment-grade corporate bonds typically yielding 1-2% more to compensate for additional risk.

What makes bonds exceptionally valuable is their performance during equity market turbulence. During the 2008 financial crisis, while the S&P 500 lost approximately 37%, long-term government bonds gained nearly 26%. This counter-cyclical relationship underpins modern portfolio theory.

Economic factors impact these asset classes in predictable yet opposite ways. Rising interest rates typically pressure bond prices downward but may benefit certain equity sectors. Inflation erodes the real returns of fixed-income investments more severely than stocks, as companies can often raise prices to maintain profit margins.

| Economic Condition | Stock Market Response | Bond Market Response | Historical Example |

|---|---|---|---|

| Economic Expansion | Strong positive returns | Modest or negative returns | 1990s Tech Boom |

| Economic Contraction | Negative returns | Positive returns | 2008 Financial Crisis |

| Rising Inflation | Mixed (sector-dependent) | Negative returns | 1970s Stagflation |

| Low Interest Rates | Generally positive | Initial gains, then lower yields | 2010-2020 Period |

Monetary policy decisions by central banks create ripple effects through both markets. When the Federal Reserve lowers interest rates, bonds already in circulation become more valuable as they offer higher yields than newly issued ones. Simultaneously, stocks often rally as companies benefit from cheaper borrowing costs.

The cyclical nature of these performance patterns becomes evident when examining different decades. The 1970s saw poor stock performance amid high inflation, while bonds struggled as well. The 1980s and 1990s delivered exceptional stock returns as inflation moderated and technology transformed the economy.

More recently, the period from 2000-2009 has been called the “lost decade” for stocks, with the S&P 500 delivering negative returns while bonds outperformed. Then from 2010-2020, stocks dramatically outpaced bonds during a period of historically low interest rates and accommodative monetary policy.

Understanding these historical relationships helps investors set realistic expectations. While past performance doesn’t guarantee future results, these patterns provide valuable context for how different asset classes respond to economic conditions. This knowledge becomes indispensable when constructing portfolios designed to weather various market environments.

Risk Factors in Stocks vs Bonds

The distinction in risk between stocks and bonds is profound, each presenting unique challenges for investors. Grasping these distinct risk profiles is imperative for constructing a portfolio that resonates with your financial aspirations and personal comfort with market fluctuations.

Stock Market Risks

Stocks are generally riskier than bonds, mainly due to inherent market volatility. Acquiring shares in a company subjects you to both systematic risks (affecting the entire market) and unsystematic risks (specific to that company).

Market volatility in stocks can be gauged through statistical tools like standard deviation, which quantifies price deviations from the average. A higher standard deviation signifies greater volatility and risk. Beta, another metric, compares a stock’s volatility to the overall market.

Real-world examples of stock market risks include:

- Company-specific events (earnings misses, management changes)

- Industry disruptions (new technologies, regulatory changes)

- Macroeconomic factors (recessions, inflation)

- Geopolitical events (trade wars, international conflicts)

During downturns, stocks can plummet in value rapidly. For instance, the 2020 COVID-19 market crash saw the S&P 500 plummet by about 34% in just 33 days—the fastest decline of that magnitude in history.

Bond Market Risks

While generally safer than stocks, bonds harbor their own set of risks that investors must grasp. The primary risk factor for bonds is interest rate risk—the inverse relationship between interest rates and bond prices.

When interest rates rise, existing bond prices fall. This occurs because newer bonds are issued at higher interest rates, rendering older, lower-yielding bonds less attractive. The longer a bond’s duration (time to maturity), the more sensitive it is to interest rate changes.

Credit risk represents another significant concern for bond investors. This is the possibility that the bond issuer will default on their obligations. U.S. Treasury bonds carry minimal credit risk, while corporate bonds—specifically high-yield or “junk” bonds—carry substantially more.

Other bond risks include:

- Inflation risk: Rising inflation erodes the purchasing power of fixed bond payments

- Liquidity risk: Some bonds may be difficult to sell quickly without price concessions

- Call risk: Issuers may redeem bonds early when interest rates fall

| Risk Factor | Stocks | Bonds | Impact on Portfolio |

|---|---|---|---|

| Volatility | High | Low to Moderate | Affects short-term stability |

| Interest Rate Sensitivity | Moderate | High | Influences fixed income returns |

| Inflation Impact | Mixed (can hedge) | Negative | Affects real returns |

| Default Risk | Company bankruptcy | Issuer default | Potential for capital loss |

Diversification Benefits

The contrasting risk profiles of stocks and bonds offer powerful opportunities for portfolio diversification. When combined appropriately, these asset classes can potentially reduce overall portfolio volatility without proportionally reducing returns.

This benefit arises from the concept of correlation—the degree to which two investments move in relation to each other. Stocks and bonds often (though not always) have low or negative correlation, meaning they may move in opposite directions during certain market conditions.

Modern portfolio theory introduces the concept of the efficient frontier—a curve representing portfolios that maximize expected returns for a given level of risk. By combining stocks and bonds in varying proportions, investors can potentially position themselves at optimal points along this frontier.

Aligning Risk with Personal Tolerance

Your personal risk tolerance should heavily influence how you balance stocks and bonds in your portfolio. Risk tolerance is determined by several factors:

- Time horizon (longer horizons can typically withstand more volatility)

- Financial goals (growth vs. income vs. preservation)

- Personal comfort with market fluctuations

- Overall financial situation (emergency funds, income stability)

Younger investors with longer time horizons might accept higher stock allocations despite increased volatility. In contrast, those nearing or in retirement often shift toward bonds to reduce the risk of significant drawdowns that could affect their income needs.

We recommend periodically reassessing your risk tolerance as life circumstances change. Major events like career changes, family additions, or approaching retirement may necessitate adjustments to your stock-bond allocation to maintain alignment with your comfort level and financial objectives.

Returns on Investment: Stocks vs Bonds

An examination of the return characteristics of stocks and bonds offers critical insights into their roles within an investment portfolio. The evaluation of investment options hinges on returns, yet these must be contextualized against the backdrop of inherent risks.

Historically, stocks have surpassed bonds in terms of returns over extended periods. The S&P 500 has averaged around 10% annual return, whereas long-term government bonds have yielded approximately 5-6% annually. This disparity underlines the significance of stocks as the primary growth drivers in most portfolios.

Despite these averages, there exist nuanced variations within each asset class. Stock returns are influenced by market capitalization and investment style:

| Stock Category | Average Annual Return (1926-2022) | Volatility (Standard Deviation) |

|---|---|---|

| Large-Cap Growth | 9.8% | 17.2% |

| Large-Cap Value | 10.5% | 14.9% |

| Small-Cap Growth | 9.3% | 22.6% |

| Small-Cap Value | 12.1% | 19.4% |

This data highlights that value stocks have historically outperformed growth stocks, with small-cap stocks exhibiting higher volatility. These distinctions are critical when constructing a portfolio tailored to specific financial goals.

Bond returns also vary across categories. Treasury bonds offer lower yields but maximum safety, while corporate and high-yield bonds provide enhanced returns with corresponding increases in risk. The current interest rate environment significantly impacts bond performance, with rising rates typically causing existing bond prices to fall.

| Bond Category | Average Annual Return (1926-2022) | Volatility (Standard Deviation) |

|---|---|---|

| Treasury Bonds (10-year) | 5.5% | 5.7% |

| Corporate Bonds (Investment Grade) | 6.2% | 8.4% |

| Municipal Bonds | 4.8% | 5.9% |

| High-Yield Corporate Bonds | 7.8% | 11.2% |

Bond duration is a critical factor in return expectations. Longer-term bonds typically offer higher yields to compensate for greater interest rate risk. The yield curve—which plots yields against maturity dates—provides valuable insights into market expectations about future economic conditions.

When comparing stocks and bonds, sophisticated investors look beyond raw returns to examine risk-adjusted performance. The Sharpe ratio measures excess return per unit of risk, while the Sortino ratio focuses on downside risk. Jensen’s alpha evaluates performance relative to expected returns based on market risk.

These metrics often reveal that bonds, despite generating lower absolute returns, can deliver competitive risk-adjusted performance—often during market downturns. During the 2008 financial crisis, for example, Treasury bonds gained value while stocks plummeted, demonstrating their value as portfolio stabilizers.

Inflation represents another critical factor when evaluating returns. Stocks have historically provided better inflation protection than bonds, with companies often able to raise prices during inflationary periods. Fixed-income investments, by contrast, see their real returns eroded when inflation exceeds their yield.

For investors building a portfolio, these return characteristics suggest different roles for each asset class. Stocks serve as growth engines that build wealth over time, while bonds provide income, stability, and capital preservation. The optimal allocation depends on your time horizon, risk tolerance, and specific financial objectives.

We recommend investors consider both geometric and arithmetic mean returns when setting expectations. The geometric mean (which accounts for compounding) provides a more accurate picture of actual experienced returns over time, while the arithmetic mean helps understand the range of possible annual outcomes.

“The investor’s chief problem—and even his worst enemy—is likely to be himself.”

This wisdom reminds us that emotional reactions to market volatility often lead investors to buy high and sell low, undermining long-term returns. A well-designed portfolio of stocks and bonds can help moderate these behavioral tendencies by reducing overall volatility while maintaining reasonable growth.

How to Choose Between Stocks and Bonds

The selection of stocks and bonds necessitates a comprehension of three fundamental elements: financial objectives, risk tolerance, and investment horizon. These components are the bedrock of asset allocation strategies, tailored to individual circumstances, eschewing generic advice.

Assessing Your Financial Goals

Diverse financial objectives necessitate disparate investment methodologies. Each goal—retirement planning, education savings, and home acquisition—demands a unique strategy.

For retirement planning, a long-term perspective often permits a higher stock allocation, predominantly in the early stages. For instance, if retirement is 30 years away, allocating 80-90% to stocks can maximize growth.

Education funding, with its defined timeline, benefits from a gradual shift from stocks to bonds as the child approaches college age. A common strategy is to initiate with 70-80% in stocks, then reduce to 20-30% as college nears.

Short-term objectives, such as down payments for homes (within 1-3 years), require conservative allocations, heavily skewed towards bonds or cash equivalents to safeguard capital.

Understanding Your Risk Tolerance

Risk tolerance encompasses both objective capacity and subjective willingness to endure market volatility. Objective capacity is contingent upon financial stability—emergency savings, stable income, and net worth. Individuals with robust financial foundations, such as six months of emergency funds and multiple income streams, exhibit greater capacity for risk-taking.

Subjective risk tolerance reflects emotional comfort with market fluctuations. Consider how you would react to a 20% market decline. Would you panic sell or remain steadfast? Honesty about your comfort with temporary losses is essential.

Reflect on these self-assessment queries:

- Have past market downturns caused you significant stress?

- Do you frequently check your investment values?

- Would you sacrifice returns for greater stability?

If affirmative responses to these questions are evident, a bond-heavy portfolio may be more suitable, reflecting lower risk tolerance.

Evaluating Your Time Horizon

Your investment timeframe profoundly influences optimal asset allocation. Longer horizons typically support higher equity allocations, leveraging the capacity to navigate short-term volatility.

Historical data indicates that while stocks exhibit greater short-term volatility, they have consistently outperformed bonds over periods exceeding 10 years. This makes time horizon a critical, objective factor in determining your allocation strategy.

| Time Horizon | Life Stage | Suggested Stock Allocation | Suggested Bond Allocation | Rationale |

|---|---|---|---|---|

| 30+ years | Early career | 80-90% | 10-20% | Maximum growth, ample time to recover from downturns |

| 15-30 years | Mid-career | 70-80% | 20-30% | Growth-focused with moderate stability |

| 5-15 years | Pre-retirement | 50-60% | 40-50% | Balanced approach with increasing focus on capital preservation |

| Under 5 years | Retirement/Goal achievement | 20-40% | 60-80% | Capital preservation with inflation protection |

These allocations serve as starting points, not rigid rules. Personal circumstances may necessitate adjustments to these guidelines. For example, a retiree with substantial pension income might comfortably maintain higher stock allocations than typical for their age group.

The most effective strategy integrates goals, risk tolerance, and time horizon into a personalized asset allocation plan. This plan evolves as life circumstances change. Regular portfolio reviews ensure the investment mix remains aligned with current objectives and circumstances.

The Role of Stocks and Bonds in a Portfolio

Stocks and bonds, as complementary elements within a well-crafted investment portfolio, each embody distinct yet interconnected roles. Grasping the synergy between these assets is imperative for fortifying financial resilience and realizing long-term objectives. The strategic equilibrium between these investment vehicles constitutes the bedrock of portfolio diversification and effective asset allocation.

In the construction of a portfolio, investors must contemplate the growth-oriented nature of stocks juxtaposed against the stability offered by bonds. This symbiotic relationship establishes a financial ecosystem where each asset class can potentially mitigate the vulnerabilities of the other. During market downturns, high-quality bonds often retain their value or even appreciate, serving as a buffer against the decline in stock prices.

Asset Allocation Strategies

Effective asset allocation entails the distribution of investments across various asset classes to optimize the risk-return spectrum. Three primary methodologies guide this endeavor:

- Strategic allocation maintains fixed percentages of stocks and bonds irrespective of market conditions, typically adjusted only when life circumstances change.

- Tactical allocation allows for temporary adjustments based on market outlook, increasing stock exposure during bull markets and shifting toward bonds during uncertain periods.

- Core-satellite approach combines a stable core of index funds with specialized satellite investments targeting specific opportunities.

The appropriate strategy hinges on your investment timeline, risk tolerance, and financial objectives. Younger investors, with decades until retirement, can typically withstand more volatility and may benefit from higher stock allocations. In contrast, those nearing retirement often shift toward bonds to preserve capital.

Beyond the basic stock-bond division, true portfolio diversification extends into subcategories within each asset class. Stock holdings can span different market capitalizations, sectors, and geographic regions. Bond allocations might include varying durations, credit qualities, and issuer types.

“The only investors who shouldn’t diversify are those who are right 100% of the time.”

Understanding correlation—how different investments move in relation to each other—is essential for effective diversification. Assets with low or negative correlations tend to move in opposite directions, potentially reducing overall portfolio volatility. Historically, high-quality bonds have shown low correlation with stocks, making them valuable diversification tools.

Sample Portfolio Models

Different life stages and risk tolerances necessitate varying approaches to the stock-bond balance. The table below illustrates sample allocation models that might serve as starting points for different investor profiles:

| Investor Profile | Stocks | Bonds | Risk Level | Primary Goal |

|---|---|---|---|---|

| Aggressive Growth (20s-30s) | 80-90% | 10-20% | High | Long-term capital appreciation |

| Balanced Growth (40s-50s) | 60-70% | 30-40% | Moderate | Growth with increasing stability |

| Pre-Retirement (50s-60s) | 40-60% | 40-60% | Moderate-Low | Capital preservation with growth |

| Income-Focused (65+) | 20-40% | 60-80% | Low | Income generation and stability |

These allocations serve as general guidelines, not rigid rules. Individual circumstances, market conditions, and personal comfort with volatility should always influence your specific approach.

Performance Through Market Cycles

Historical data reveals how balanced portfolios have weathered various market conditions. During the 2008 financial crisis, a portfolio with 60% stocks and 40% bonds experienced roughly half the drawdown of an all-stock portfolio. Similar resilience was observed during the pandemic-induced market crash of March 2020, where balanced portfolios demonstrated significantly less volatility.

Conversely, during strong bull markets like the 2010s, all-stock portfolios outperformed balanced approaches. This outperformance came with substantially higher volatility and deeper drawdowns during corrections.

The complementary nature of stocks and bonds becomes evident during economic transitions. When economic growth slows, central banks often lower interest rates, which typically benefits bond prices while stocks may struggle. This counter-cyclical relationship helps explain why the traditional 60/40 portfolio has remained a benchmark for balanced investing.

Rebalancing—periodically adjusting your portfolio back to target allocations—serves as a disciplined approach to maintaining your desired risk level while potentially maximizing returns. This process naturally implements the investor’s wisdom to “buy low and sell high” by trimming assets that have appreciated and adding to those that have underperformed.

The optimal mix of stocks and bonds in your portfolio ultimately depends on your personal financial journey. By understanding the distinct roles these assets play and how they interact, you can construct a portfolio aligned with both your long-term objectives and your comfort with market fluctuations.

Tax Implications of Stocks and Bonds

In the realm of investment options, stocks and bonds, the often-overlooked factor of taxation significantly influences real-world returns. Grasping the tax implications of various financial assets is imperative for making informed investment decisions, aiming to maximize after-tax wealth.

Capital Gains Tax on Stocks

Stock investments incur tax liability mainly through capital gains and dividends. The timing of stock sales profoundly affects tax burden. Short-term capital gains, assets held under a year, are taxed at the investor’s ordinary income rate, potentially up to 37% for high-income earners.

Conversely, long-term capital gains, assets held over a year, benefit from preferential tax rates of 0%, 15%, or 20%, contingent upon the investor’s income bracket. This tax advantage incentivizes buy-and-hold strategies in equities.

Qualified dividends are taxed at the same rates as long-term capital gains, while non-qualified dividends are taxed as ordinary income. Most dividends from U.S. corporations and qualified foreign corporations are eligible for this preferential treatment, provided holding period requirements are met.

Tax-Efficient Stock Strategies

Investors employ various strategies to minimize tax impact on stock investments. Tax-loss harvesting involves selling underperforming investments to realize losses, offsetting capital gains and up to $3,000 of ordinary income annually. Excess losses can be carried forward to future tax years.

Another strategy is strategic timing of sales to manage tax brackets or take advantage of years with lower income. Some investors also utilize direct indexing, which offers more granular tax-loss harvesting opportunities than traditional index funds.

Bond Taxation Variations

Bond interest typically faces less favorable tax treatment than long-term capital gains from stocks. Interest from corporate bonds is fully taxable at federal and state levels at ordinary income rates. This higher tax burden can significantly reduce the effective yield of corporate bonds.

Treasury bonds and Treasury bills offer a partial tax advantage—their interest is exempt from state and local taxes but remains subject to federal income tax. This creates a higher effective yield for investors in high-tax states compared to the stated yield.

Municipal bonds (“munis”) provide the most favorable tax treatment among bond types. Interest from these bonds is generally exempt from federal income taxes and, if issued in your state of residence, may also be exempt from state and local taxes. This “triple tax exemption” makes municipal bonds highly attractive for high-income investors in high-tax states.

Tax-Equivalent Yield

When comparing taxable and tax-exempt bonds, investors should calculate the tax-equivalent yield to make fair comparisons. This formula adjusts the yield of tax-exempt bonds to show what a taxable bond would need to yield to provide the same after-tax return:

Tax-equivalent yield = Tax-exempt yield ÷ (1 – Marginal tax rate)

For example, a municipal bond yielding 3% for an investor in the 35% tax bracket has a tax-equivalent yield of approximately 4.62%, making it potentially more attractive than a corporate bond yielding 4%.

Tax-Advantaged Accounts

The location of your investment options within your overall financial structure is as critical as the investments themselves. Tax-advantaged accounts significantly alter the tax equation:

- Traditional 401(k)s and IRAs: Contributions are typically tax-deductible, and investments grow tax-deferred, but withdrawals are taxed as ordinary income.

- Roth 401(k)s and IRAs: Contributions are made with after-tax dollars, but qualified withdrawals, including all growth, are completely tax-free.

- 529 Plans: These education-focused accounts offer tax-free growth and withdrawals when used for qualified education expenses.

Asset Location Strategy

Optimizing which investments go into which accounts can enhance after-tax returns. Generally, tax-inefficient investments that generate ordinary income (like corporate bonds or REITs) are best held in tax-advantaged accounts. Tax-efficient investments like growth stocks or municipal bonds often make more sense in taxable accounts.

The same investment can produce dramatically different after-tax outcomes depending on account placement. For instance, a corporate bond yielding 5% held in a taxable account by someone in the 32% tax bracket would effectively yield only 3.4% after federal taxes. The same bond in a traditional IRA would defer taxes until withdrawal, potentially at a lower rate during retirement.

Understanding these tax implications allows investors to make more informed decisions about their financial assets, potentially increasing their after-tax returns without taking on additional market risk. This tax-aware approach to investing represents one of the few “free lunches” available in personal finance.

Active vs Passive Investment Strategies

Investment strategies diverge into active and passive paradigms, each with its own set of advantages and disadvantages. Grasping these contrasting methodologies is essential for aligning one’s portfolio management with their financial objectives, risk tolerance, and personal inclinations.

Understanding Active Investment Strategies

Active investing entails a hands-on approach, aiming to surpass market benchmarks. Portfolio managers or individual investors make deliberate decisions regarding the acquisition and disposal of securities, predicated on thorough research, analysis, and market forecasts.

In the stock market, active investors employ several key strategies:

- Fundamental analysis – Evaluating companies based on financial statements, competitive position, and growth prospects

- Growth investing – Focusing on companies with above-average growth prospects, often at premium valuations

- Value investing – Seeking undervalued companies trading below their intrinsic worth

- Momentum investing – Following market trends by buying rising securities and selling declining ones

Active bond investors also strive to generate alpha through credit analysis, interest rate forecasting, and tactical adjustments to duration and credit quality as market conditions evolve.

“The active investor is looking for mistakes that other investors make. The idea is to find securities that are mispriced relative to some notion of fair value.”

The Passive Approach to Investing

Passive investing adopts a “buy and hold” stance, typically through index funds or ETFs that mirror specific market benchmarks. Unlike active investors, passive investors aim to capture market returns while minimizing costs and portfolio turnover.

In the bond market, passive strategies include:

- Bond index funds – Tracking broad fixed-income indices like the Bloomberg US Aggregate Bond Index

- Bond laddering – Purchasing bonds with staggered maturity dates to create predictable income streams

- Target-date funds – Automatically adjusting stock/bond allocations as investors approach retirement

Passive stock investing typically involves purchasing broad-market index funds that track benchmarks like the S&P 500, total stock market indices, or sector-specific indices. This approach is founded on the efficient market hypothesis, which posits that security prices already reflect all available information.

Performance Comparison: Active vs Passive

Historical data presents a challenging picture for active management. According to S&P Dow Jones Indices’ SPIVA Scorecard, over 15-year periods, approximately 90% of actively managed U.S. equity funds underperform their benchmarks after accounting for fees.

Nonetheless, active management can excel during certain market conditions. During periods of high volatility or market stress, skilled active managers may provide downside protection by adjusting portfolios defensively. Some specialized market segments, such as fixed income and emerging markets, have historically offered more opportunities for active management success.

| Factor | Active Investing | Passive Investing | Key Consideration |

|---|---|---|---|

| Average Annual Fees | 0.5% – 1.5% | 0.03% – 0.25% | Fee differential compounds significantly over time |

| Tax Efficiency | Lower (higher turnover) | Higher (lower turnover) | Particularly important in taxable accounts |

| Time Commitment | High | Low | Consider your interest and availability |

| Downside Protection | Potentially better | Market exposure | Active strategies may reduce losses in bear markets |

| Performance Consistency | Variable | Consistent with benchmark | Passive provides predictable relative performance |

The Market Efficiency Debate

The debate between active and passive investing often centers around market efficiency. Efficient markets theory suggests that security prices reflect all available information, making it difficult to consistently outperform through security selection.

Active management proponents counter that market inefficiencies do exist, predominantly in less-researched segments like small-cap stocks, emerging markets, and certain fixed-income sectors. These inefficiencies potentially create opportunities for skilled investors to generate alpha.

The reality likely falls somewhere in between—markets are generally efficient but contain pockets of inefficiency that skilled investors might exploit. Identifying truly skilled managers in advance remains challenging.

Finding Your Investment Approach

When deciding between active and passive strategies, consider these factors:

- Investment goals – Income needs, growth targets, and time horizon

- Cost sensitivity – Impact of fees on long-term returns

- Tax situation – Implications for taxable versus tax-advantaged accounts

- Personal interest – Your desire to be involved in investment decisions

- Behavioral tendencies – Your emotional response to market volatility

Many successful investors adopt a core-satellite approach, combining passive investments as the portfolio foundation with selective active strategies in areas where they believe inefficiencies exist or where they have particular expertise.

“The question is not whether markets are efficient. The question is how efficient they are, and more importantly, whether there are pockets of inefficiency that can be exploited by skilled investors.”

Both active and passive strategies have their place in modern portfolio construction. Viewing them as mutually exclusive options is misguided. Instead, consider how each approach might serve different components of your investment plan. The optimal strategy often combines elements of both, tailored to your specific financial situation, goals, and personal preferences.

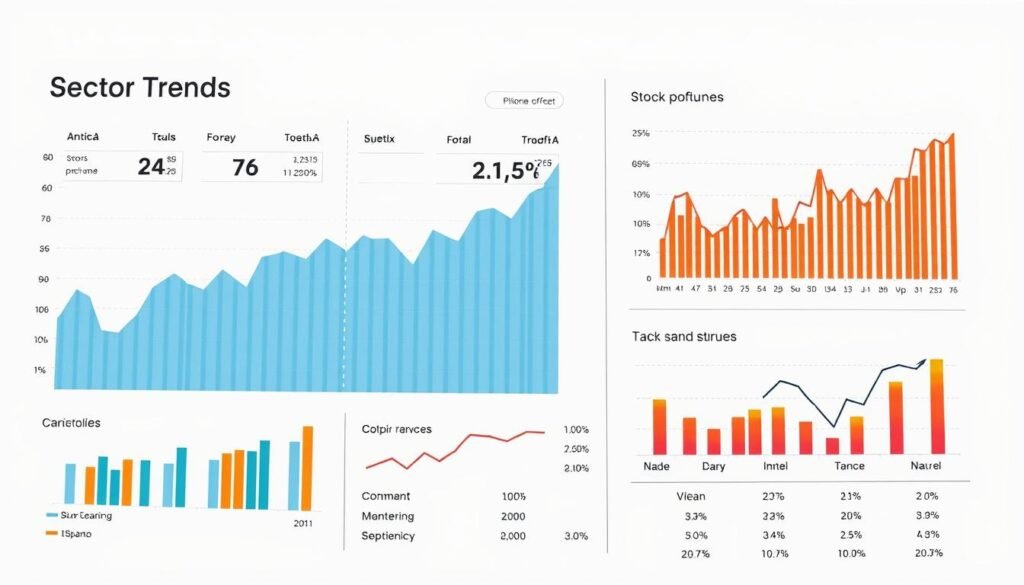

Current Trends in the Market

The contemporary market landscape is characterized by a complex interplay of divergent sectoral performances within the stock market and the evolving dynamics of the bond market. Grasping these trends is imperative for making informed investment choices in the current economic climate.

The stock market has demonstrated remarkable resilience in 2024, despite encountering sector-specific challenges. Industrial stocks have plummeted by 5.7% over the past six months, whereas the broader S&P 500 has maintained relative stability. This disparity underlines the critical role of sector allocation in the current market environment.

Technology and artificial intelligence-related stocks have been the primary drivers of market momentum, whereas traditional sectors face challenges from shifting consumer behaviors and supply chain adjustments. Valuation metrics in growth-oriented sectors remain elevated, suggesting a vulnerability to earnings disappointments.

Conversely, the bond market is navigating a complex interest rate environment. The yield curve shape has become a focal point for investors, providing insights into market expectations regarding future economic conditions. Credit spreads have remained relatively tight, indicating investor confidence in corporate financial health.

Central bank policies exert a dominant influence on fixed-income markets. Investors are keenly monitoring signals about future rate decisions and their implications for bond valuations across different duration profiles. Municipal bonds have garnered attention for their tax advantages in the current yield environment.

Political developments are introducing both uncertainty and opportunities across market segments. The upcoming political transition in 2025 has investors speculating about possible policy shifts in taxation, regulation, and government spending priorities. These factors could significantly reshape sector performance in both equity and fixed-income markets.

“Market participants are increasingly focused on positioning portfolios for possible policy shifts, as opposed to reacting to current economic data,” notes a recent financial market analysis from the Federal Reserve Bank of New York.

For investors, these trends necessitate several practical considerations. Sector rotation strategies may prove valuable as different segments of the market respond differently to evolving economic conditions. Duration management in bond portfolios deserves meticulous attention given the current interest rate climate.

The relative attractiveness of various investment vehicles continues to shift with market conditions. Exchange-traded funds (ETFs) focusing on specific sectors or themes have seen strong inflows as investors seek targeted exposure to areas of perceived opportunity.

Despite these observable trends, we emphasize that investors should avoid making dramatic portfolio changes based solely on short-term market movements or predictions. The fundamentals of diversification and alignment with long-term financial goals remain essential principles even as market dynamics evolve.

For those holding balanced portfolios, the current environment may warrant a review of allocations between stocks and bonds to ensure they remain aligned with risk tolerance and investment objectives. The divergent performance across sectors also highlights the benefits of maintaining exposure to a broad range of market segments, avoiding concentration in areas that have recently outperformed.

Tips for Beginners: Investing in Stocks & Bonds

New investors often face the daunting task of where to start. These actionable tips can assist in establishing a foundation in both stock and bond investing. The financial markets, though complex, can be navigated with the right knowledge and strategy.

Embarking on your investment journey necessitates grasping the fundamentals before committing substantial capital. It is advisable to first build a robust educational foundation. Subsequently, take incremental steps as your confidence and acumen grow.

Getting Started with Stocks

Several accessible investment options make entering the stock market less daunting for beginners:

- Low-cost index funds – These funds track market indexes like the S&P 500, providing instant diversification with minimal research required. Many have low minimum investments starting at just $1-$100.

- Fractional shares – Instead of buying whole shares of expensive stocks, platforms like Robinhood and Fidelity allow you to purchase portions of shares with as little as $1.

- Dividend Reinvestment Plans (DRIPs) – These programs automatically reinvest your dividends to purchase additional shares, accelerating your wealth-building through compounding.

Setting Up Your First Stock Investment

Follow these steps to initiate your stock investing journey:

- Research and select an online brokerage that offers low fees and educational resources (Fidelity, Charles Schwab, or Vanguard are solid choices).

- Open an account by providing identification and linking your bank account.

- Start with a small, regular investment plan—even $50-100 monthly builds good habits.

- Consider setting up automatic investments to enforce discipline.

- Begin with broad-market ETFs before advancing to individual stocks.

Bond Investing for Beginners

Bonds offer more stability than stocks and can be an excellent component of portfolio diversification. Here are beginner-friendly bond options:

- Treasury securities – U.S. government bonds are among the safest investments and can be purchased directly through TreasuryDirect.gov with minimums as low as $100.

- I-Bonds – These inflation-protected savings bonds adjust with inflation rates, making them valuable during high-inflation periods.

- Bond ETFs – Exchange-traded funds like Vanguard’s BND provide exposure to hundreds of bonds in a single investment, ensuring instant diversification.

- Bond mutual funds – These professionally managed funds allow you to access bond markets with relatively small investments while leaving selection to experts.

The individual investor should act consistently as an investor and not as a speculator. This means that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.

Essential Resources for New Investors

Before making significant investments, arm yourself with knowledge through these resources:

- Educational materials: Books like “The Bogleheads’ Guide to Investing” and “A Random Walk Down Wall Street” provide solid foundations. Websites such as Investopedia and Khan Academy offer free courses.

- Investment tools: Portfolio analyzers (Personal Capital), asset allocation calculators (Vanguard’s tool), and risk assessment questionnaires help tailor your approach.

- Professional guidance: Consider robo-advisors like Betterment or Wealthfront for low-cost automated investing, or consult a fee-only financial planner for personalized advice.

Progression Roadmap for Beginners

Follow this path to gradually increase your investment sophistication:

- Month 1-3: Focus on education and setting up accounts.

- Month 4-6: Begin regular investments in broad-market index funds or ETFs.

- Month 7-12: Add bond exposure through ETFs or Treasury securities.

- Year 2: Consider more specialized funds in sectors you understand.

- Year 3+: If desired, begin researching and adding individual stocks or bonds, keeping them to a small percentage of your portfolio.

Remember that successful investing is a marathon, not a sprint. Start small, stay consistent, and focus on learning. By gradually building your knowledge alongside your portfolio, you’ll develop the confidence to make increasingly sophisticated investment decisions.

The most important step is simply to begin. Even modest investments, when started early and maintained consistently, can grow substantially over time. This is due to the power of compounding and proper portfolio diversification between stocks and bonds.

Conclusion

The exploration of stocks versus bonds transcends the quest for a singular solution, evolving into a personalized odyssey. It is a journey towards identifying the optimal asset allocation tailored to your unique circumstances. This allocation will naturally adapt as your objectives and risk appetite undergo transformations over time.

Engaging in periodic portfolio assessments is imperative. Schedule these evaluations at regular intervals, whether quarterly or annually. During these sessions, pose critical inquiries: Have your financial aspirations altered? Has your time horizon for achieving these goals been compressed? Does your current risk posture align with your comfort threshold?

Market dynamics are inherently unpredictable, yet it is critical to eschew impulsive decisions based on ephemeral market fluctuations. Opt for incremental adjustments when your life circumstances undergo substantial transformations—such as nearing retirement, acquiring an inheritance, or encountering significant financial obligations.

Diversification emerges as the cornerstone of a resilient investment strategy. A judicious blend of stocks and bonds serves as a bulwark against the vicissitudes of the market, facilitating the pursuit of your financial objectives.

Investors who achieve success recognize that asset allocation is a continuous, not a static, endeavor. By adhering to the principles elucidated and engaging in regular reassessments of your evolving needs, you can construct a portfolio that expands in tandem with your financial progression at every juncture.